Quick Answer: Focus Primarily on ChatGPT

While ChatGPT dominates globally with 80-90% of LLM traffic, be aware of regional differences, especially in US transactional queries where competition is more significant.

🌍Regional Market Share Analysis

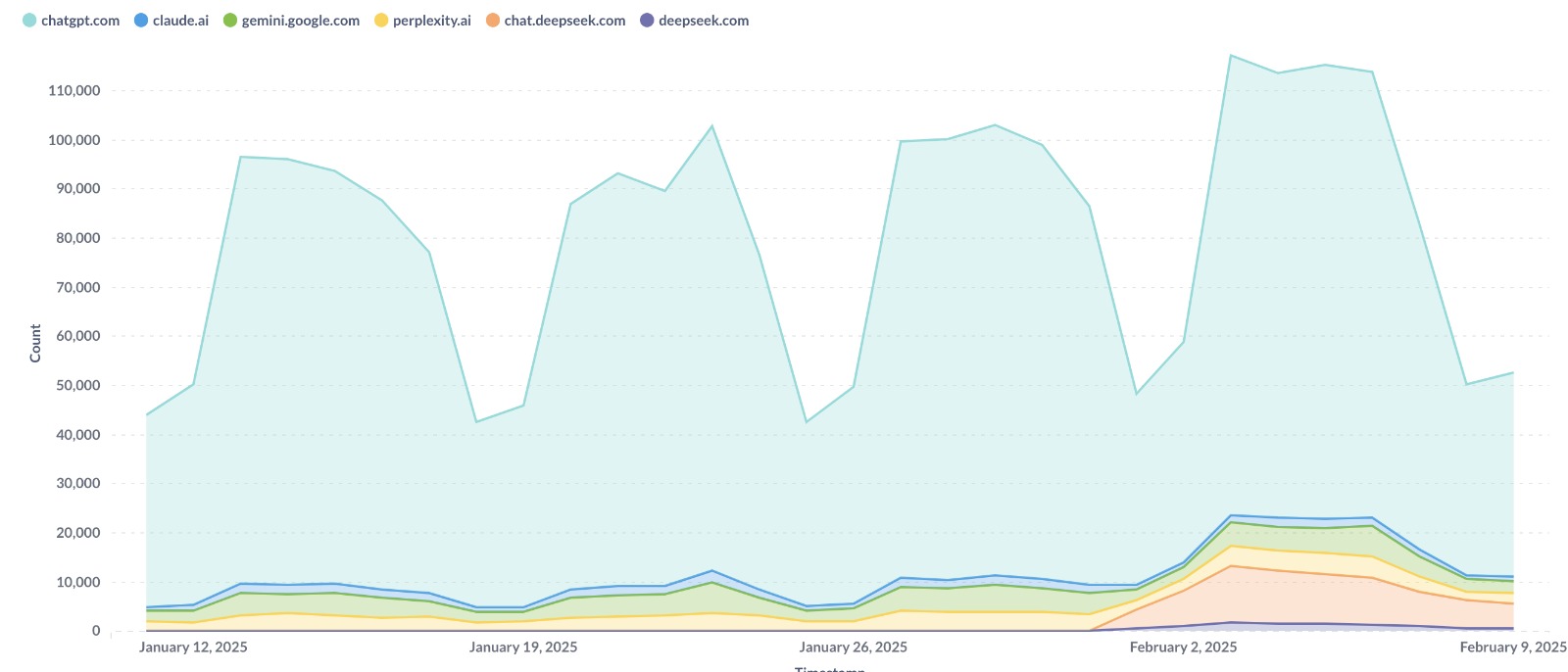

Our latest data from February 2025 reveals a more nuanced picture than previously reported, with significant regional variations in LLM usage patterns:

Europe & Asia

Focus 100% on ChatGPT

ChatGPT

90%+

Competitors

10%-

Dominance Level

Overwhelming

United States (General)

Primary focus ChatGPT, monitor competitors

ChatGPT

80-85%

Competitors

15-20%

Dominance Level

Strong

US (Transactional Queries)

Consider dual optimization

ChatGPT

60%

Competitors

40% (Perplexity)

Dominance Level

Competitive

🏆LLM Platform Comparison

ChatGPT

80-90%Primary focusStrengths

Considerations

Perplexity

10-40%*Secondary considerationStrengths

Considerations

Other LLMs

<10%Monitor onlyStrengths

Considerations

* Market Share Note: Perplexity's share varies significantly by region and query type, reaching up to 40% in US transactional queries but much lower globally.

🎯Strategic Decision Framework

Resource Efficiency

High PriorityChatGPT optimization provides maximum ROI due to dominant market share

Recommended Action:

Concentrate primary resources on ChatGPT optimization

Cross-Platform Benefits

Medium PriorityChatGPT optimization strategies often translate to other LLMs like Perplexity

Recommended Action:

Monitor spillover effects to validate optimization approaches

Regional Variations

Medium PriorityUS market shows more competition, especially for purchase-intent queries

Recommended Action:

Assess if your brand has significant US transactional focus

Market Evolution

Low PriorityLLM landscape continues evolving with new players and changing dynamics

Recommended Action:

Maintain awareness of market shifts without immediate strategy changes

🔄Cross-Platform Optimization Benefits

The good news: optimizing for ChatGPT will generally improve your visibility on Perplexity as well. Both platforms handle prompts similarly, and many of the same principles apply:

Content Quality

Both platforms prioritize authoritative, well-structured content

ChatGPT Approach

High-quality, comprehensive content

Perplexity Approach

High-quality, comprehensive content

Entity Recognition

Similar approaches to understanding brand context and relevance

ChatGPT Approach

Clear brand and product mentions

Perplexity Approach

Clear brand and product mentions

Topical Authority

Both value established authority in specific topic areas

ChatGPT Approach

Domain expertise and thought leadership

Perplexity Approach

Domain expertise and thought leadership

User Intent Matching

Different interaction styles but similar intent recognition

ChatGPT Approach

Conversational query understanding

Perplexity Approach

Search-focused query understanding

🇺🇸US Market Special Consideration

In the US, especially for transactional queries, we estimate based on our data that the market share can reach a 60/40 split between ChatGPT and Perplexity. This represents a significant shift in certain segments of the market that brands targeting US consumers should be aware of.

Key Implications for US-Focused Brands:

Transactional Focus: If your brand has significant US presence and focuses on purchase-intent queries, consider allocating some resources to understanding Perplexity's approach

Resource Allocation: Maintain primary focus on ChatGPT optimization while monitoring Perplexity performance

Strategy Overlap: Many ChatGPT optimization techniques will benefit Perplexity visibility as well

Aiso's Strategic Recommendation

For brands looking to optimize their AI presence, the strategy remains clear: focus your primary resources on ChatGPT optimization. Tools like Aiso are specifically designed to help brands maximize their visibility on ChatGPT, offering the most efficient path to reaching the majority of LLM users worldwide.

📋Strategic Summary & Action Plan

✅Immediate Actions

• Prioritize ChatGPT optimization as primary strategy

• Implement comprehensive content and visibility strategies

• Use specialized tools like Aiso for maximum efficiency

⚠️Monitor & Consider

• Track regional variations in your target markets

• Assess if your brand has significant US transactional focus

• Monitor cross-platform optimization benefits

👁️Watch & Wait

• Keep awareness of LLM landscape evolution

• Avoid spreading resources too thin across multiple platforms

• Reassess strategy only if significant market shifts occur

📚Related Strategic Insights

How intent categories differ between platforms and optimization implications

Comprehensive data on user behavior patterns and search trends

🎯Start Your ChatGPT Optimization Strategy

While it's worth monitoring the LLM landscape for significant shifts, particularly in the US market, the current data suggests that diversifying your optimization efforts equally across multiple LLMs would be an inefficient use of resources. ChatGPT's dominant global position makes it the clear priority.

🏢About Aiso

At Aiso, we help brands optimize their presence in AI responses through data-driven insights and strategic analysis. Our platform analyzes millions of ChatGPT conversations to understand market dynamics and user behavior patterns, enabling brands to make informed decisions about their AI optimization strategies.

Our comprehensive market research provides brands with the strategic intelligence needed to allocate resources effectively across the LLM landscape. Whether you're evaluating platform priorities or optimizing for maximum ROI, Aiso provides the data and tools you need to succeed in the AI-driven future.

👨💻About the Author

Ben Tannenbaum

Ben Tannenbaum is the founder of Aiso, a marketing tech company helping brands be visible in AI responses. With expertise in LLM market analysis and strategic optimization, Ben helps businesses navigate the evolving landscape of AI platforms and make data-driven decisions about their optimization investments.