The landscape of Large Language Models (LLMs) continues to evolve rapidly in 2025, with several major players competing for market share and user attention. This analysis provides insights into features, market position, and strategic implications for brands looking to optimize their AI presence.

📊Current Market Share Landscape

Market leader with comprehensive features

Rising challenger with technical excellence

Google ecosystem integration

Search-focused specialist

Various smaller platforms

Key Market Insight

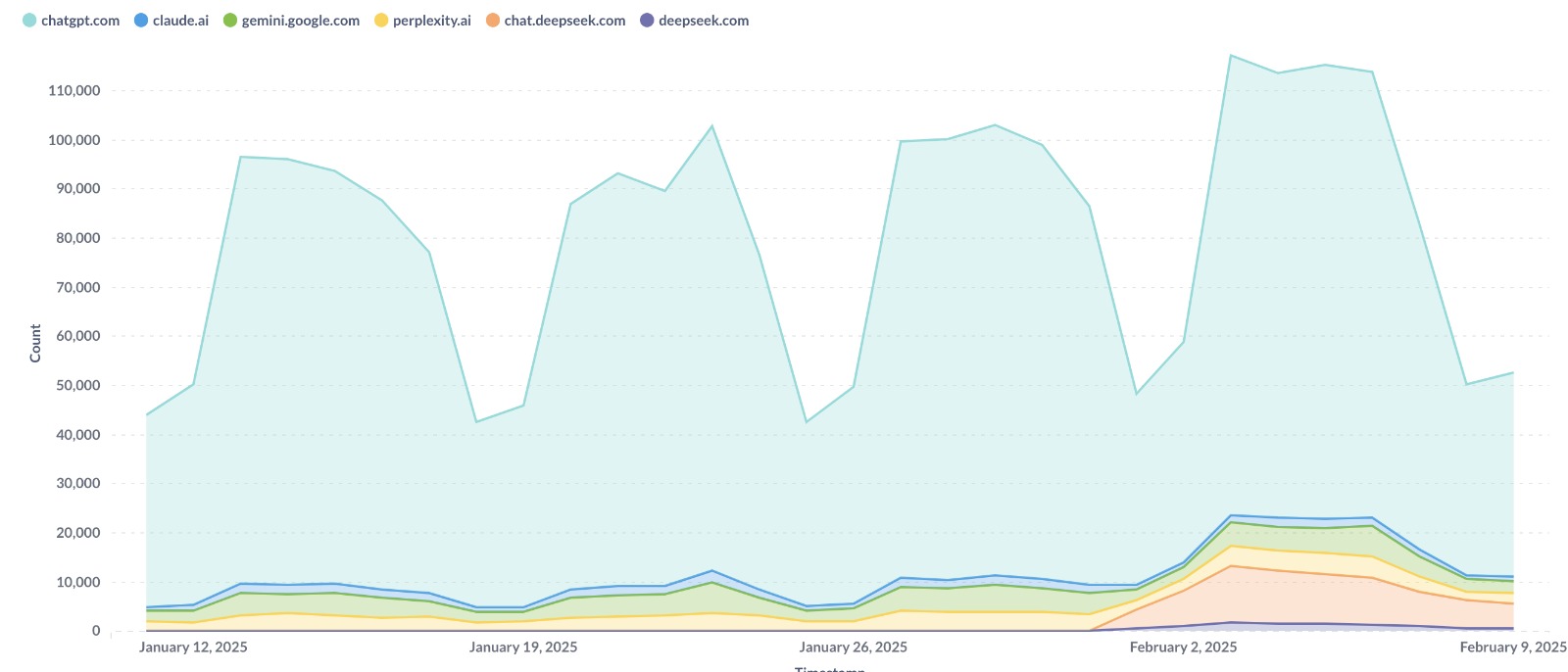

While ChatGPT maintains overall dominance, our research shows that for transactional searches (queries with purchase intent), the market is increasingly split between ChatGPT and Perplexity, particularly in the US market where we've observed a 60/40 split for these high-value queries.

Learn more about optimizing across LLMs →⚡Comprehensive Feature Comparison

Understanding the unique capabilities of each LLM is crucial for brands determining where to focus their optimization efforts:

| Feature | ChatGPT | DeepSeek | Perplexity | Claude | Gemini |

|---|---|---|---|---|---|

| Base Model Size | GPT-4o (1.8T parameters) | DeepSeek-V2 (2T parameters) | Custom (800B parameters) | Claude 3 Opus (1.5T parameters) | Gemini Ultra (1.2T parameters) |

| Context Window (Token Limit) | 128K tokens | 128K tokens | 100K tokens | 200K tokens | 2M tokens (Gemini 1.5 Pro) |

| Real-time Web Search | Yes (SearchGPT) | Limited | Yes (Core Feature) | Limited | Yes |

| Image Generation | Yes (DALL-E 3) | Yes (DeepSeek Draw) | No | Yes (Claude Vision) | Yes (Imagen) |

| Code Generation | Excellent | Excellent | Good | Very Good | Good |

| Document Analysis | Yes (100 pages) | Yes (150 pages) | Yes (Unlimited with links) | Yes (300 pages) | Yes (50 pages) |

| API Access | Comprehensive | Limited | Limited | Comprehensive | Comprehensive |

| Custom GPTs/Agents | Yes (GPT Store) | No | Limited (Labs) | Limited (Claude Artifacts) | Limited (Extensions) |

| Free Tier Availability | Yes (GPT-4o) | Yes | Limited (5 queries/day) | Limited (Claude 3 Haiku) | Yes |

Standout Feature: Gemini's massive 2 million token context window far exceeds competitors, allowing processing of approximately 1,500 pages of text in a single conversation—a 10-20x increase over previous standards.

🏆Platform Strengths and Specializations

ChatGPT

- •Market leader with the most comprehensive feature set

- •Strongest ecosystem with GPT Store and developer tools

- •Best balance of capabilities across all use cases

DeepSeek

- •Emerging challenger with superior technical performance

- •Exceptional code generation capabilities

- •Strong growth trajectory in technical communities

Perplexity

- •Search-first approach with superior real-time information

- •Strongest for transactional and research queries

- •Excellent citation and source transparency

Claude

- •Superior document analysis capabilities

- •Best-in-class for long-form content generation

- •Strongest reasoning capabilities for complex tasks

Gemini

- •Deep integration with Google ecosystem

- •Industry-leading 2M token context window

- •Strong multimodal capabilities

- •Excellent for Google Workspace users

🎯Strategic Implications for Brands

Based on our analysis of both market share and feature capabilities, here are the key strategic implications for brands looking to optimize their presence across LLMs:

1. Primary Focus on ChatGPT

With nearly 80% of global LLM traffic, ChatGPT should remain the primary focus for brand optimization efforts

2. Perplexity for Transactional Content

Brands with significant US presence should consider optimization for Perplexity, especially for product-related content

3. Monitor DeepSeek's Growth

Rapid growth trajectory suggests increasing importance, particularly for technical content and developer-focused brands

4. Leverage Cross-Platform Optimization

Many optimization strategies for ChatGPT translate to other platforms through quality content and structured data

5. Consider Vertical-Specific Strategies

Different LLMs show strengths in specific verticals - Claude for analysis, Gemini for extensive documentation

6. Evaluate Context Window Requirements

For extensive documentation or complex products, Gemini's 2M token capacity offers unique advantages

🌍Regional Considerations

Our research indicates significant regional variations in LLM usage patterns:

Europe and Asia

ChatGPT: 90%+ChatGPT maintains dominant position, clear priority for optimization

United States

ChatGPT: 60-70%More competitive landscape, Perplexity captures up to 40% of transactional queries

Technical Communities

ChatGPT: 70-80%DeepSeek shows stronger adoption among developers and technical professionals

Enterprise Markets

ChatGPT: 50-60%Claude and ChatGPT dominate, Gemini gaining in Google Workspace organizations

🔮Looking Forward: Trends to Watch

As the LLM landscape continues to evolve, several key trends are worth monitoring:

Increasing Specialization

2025-2026More domain-specific LLMs optimized for particular industries or use cases

API-First Approaches

2025Integration of LLM capabilities directly into applications and workflows

Multimodal Evolution

2025-2026Advanced processing and generation of multiple content types (text, images, audio)

Real-time Capabilities

2025Access to current information becoming standard across all major platforms

Regulatory Impact

2025-2027AI regulations creating regional variations in feature availability

Expanding Context Windows

2025-2026Continued race to increase token limits for more complex use cases

💡Key Takeaway

For brands looking to optimize their presence across LLMs, the key takeaway remains: focus primarily on ChatGPT while maintaining awareness of platform-specific strengths and regional variations. By creating high-quality, structured content that serves users well, brands can maximize their visibility across the evolving LLM landscape.

🚀Optimize Your AI Presence Strategically

Ready to develop a strategic approach to LLM optimization? Understanding these platform differences is crucial for maximizing your brand's AI visibility.

🏢About Aiso

At Aiso, we help brands optimize their presence in AI responses. Our platform analyzes millions of ChatGPT conversations to understand how users interact with AI and what they're searching for. With ChatGPT dominating approximately 80% of global LLM traffic, we focus on helping brands maximize their visibility where it matters most.

Our research into transactional search patterns provides unique insights into consumer behavior in the AI era, enabling brands to position themselves effectively in this new channel. Whether you're looking to understand how AI is reshaping your industry or need strategic guidance on optimizing your brand's presence in AI responses, Aiso provides the data-driven insights and tools you need to succeed.

👨💻About the Author

Ben Tannenbaum

Ben Tannenbaum is the founder of Aiso, a marketing tech company helping brands be visible in AI responses. With expertise in AI search optimization and content strategy, Ben helps businesses adapt to the evolving landscape of AI-powered search.