TLDR

- Hotels & Accommodations ranks #5 among commercial topics on ChatGPT with an estimated 77.5M monthly requests, just behind laptops, toys, smartphones and fashion.

- 72% of travel conversations are informational intent, meaning people use ChatGPT to explore destinations, itineraries, visas and logistics before they have decided what to book.

- Product discovery goes well beyond flights and hotels: restaurants, desserts, tours and local experiences are among the most mentioned categories.

- In many cases, a single ChatGPT conversation quietly becomes the entire marketing funnel, from first idea to purchase ready behavior, with no landing page or retargeting sequence in between.

Travel has always been one of the most searched topics online. What is changing now is where those questions start.

Instead of typing a few keywords into a search box, more and more people describe their plans, constraints and doubts directly to AI assistants like ChatGPT. That creates a different kind of signal: fewer isolated keywords, more complete conversations.

In this article, we use anonymized, fully opted in ChatGPT conversations from the Aiso dataset to answer a simple question: How popular is travel in AI search, and what do people actually talk about when they plan trips with ChatGPT?

OpenAI does not release search volume data for ChatGPT, so this type of analysis is only possible when users explicitly agree to share their conversations for research and product improvement. Our dataset covers several million opted in chats, with all personal data removed.

How Often People Search for Travel Topics

What are people searching for in ChatGPT when it comes to travel and other commercial topics?

Using a set of commercial categories that mirrors the internal taxonomy used by ChatGPT, we looked at how often different themes appear in our dataset. A few highlights:

- Hotels & Accommodations ranks #5 among commercial categories with 5.6% share and an estimated 77.5 million monthly requests.

- The top category (Laptops & Computers) reaches roughly 134 million estimated monthly requests, with travel not far behind the leaders.

- Travel outpaces categories like Insurance Products, Software & Apps, Investing, and Fitness Equipment, showing its importance as a research-heavy vertical.

Chart: Topic popularity across commercial categories (source: Aiso, based on anonymized ChatGPT conversations)

In other words, travel is not a niche in AI search. It is one of the main ways people already use ChatGPT to plan, evaluate and refine decisions.

The other important difference with traditional search is how rich those queries are. Instead of a short keyword like "best hotel Rome", a typical ChatGPT travel query looks closer to a mini brief with:

- Dates or at least a time window

- Origin city and destination, sometimes multiple destinations

- Budget constraints

- Preferences about pace, style of travel, people involved and constraints

This is the new world of online search in travel: fewer keywords, more context, more intent.

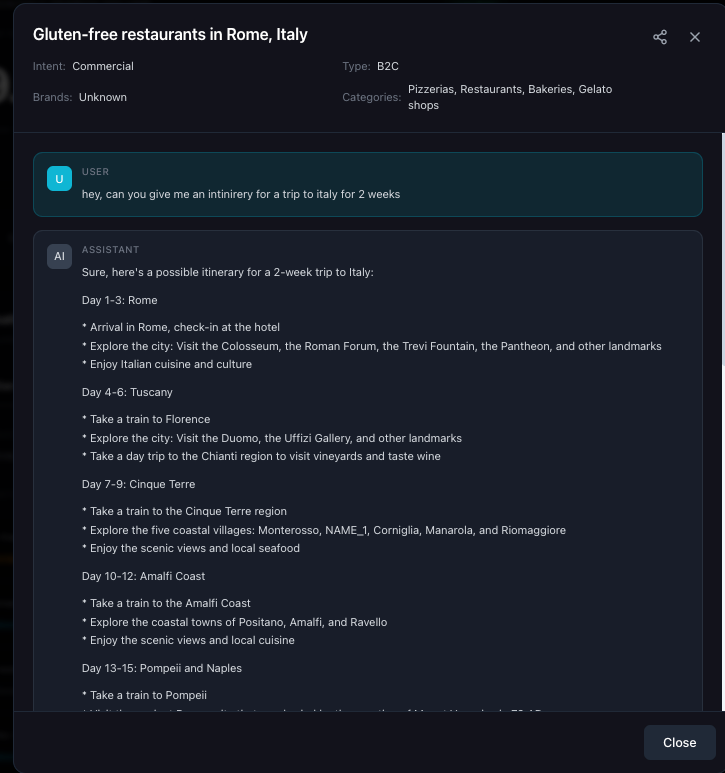

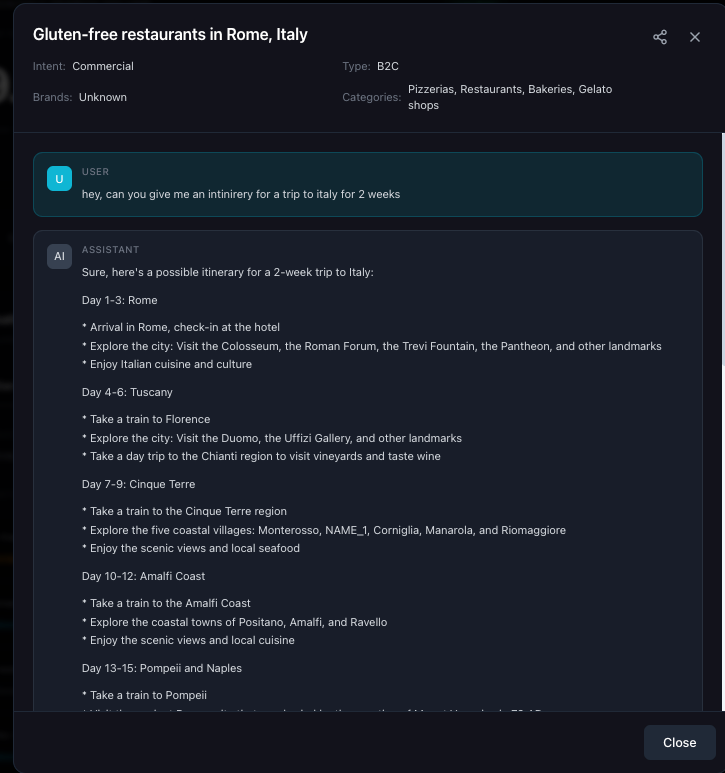

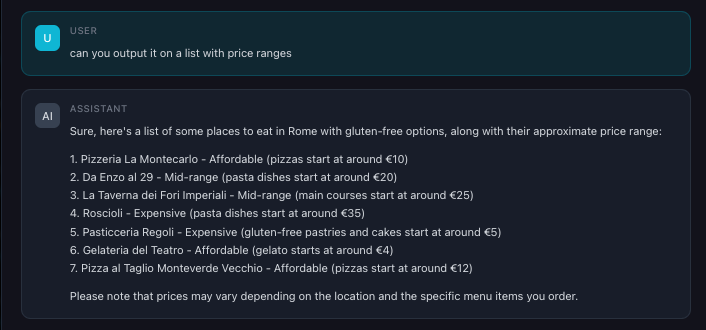

Screenshot: a real travel conversation inside ChatGPT

High Level Categories

Once we know travel is a major category in AI search, the next question is simple: what types of questions are people asking? We break this down into four lenses: intent, product types, brands mentioned, and audience and geography.

Intent

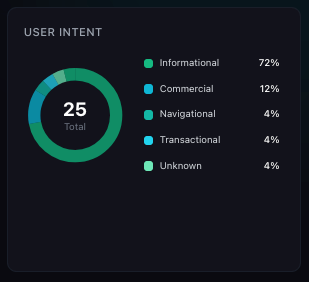

The first cut is by search intent, using the classic buckets marketers know well: informational, commercial, navigational and transactional.

| Intent Type | Percentage |

|---|---|

| Informational | 72% |

| Commercial | 12% |

| Navigational | 4% |

| Transactional | 4% |

| Unknown / Mixed | 4% |

The dominance of informational intent is a key insight. People use ChatGPT heavily to understand destinations and regions, explore possible itineraries, ask about visas, safety, logistics and local customs, and get ideas for what to do with kids, older relatives or friends.

Instead of arriving on a website already sure of what they want, many travelers are using AI to think out loud and narrow down their options.

From a marketer or product perspective, this matters a lot. It means you cannot rely only on bottom of funnel assets such as rate comparison pages. There is a huge opportunity to meet users before they have decided on a destination, a route or even a budget.

Products

The second lens is which product categories appear in travel conversations. In one representative slice of the data, we see:

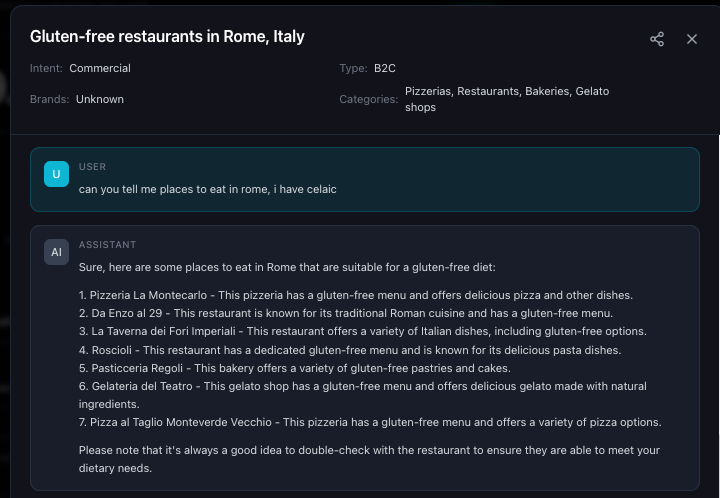

- Restaurants among the most mentioned categories

- Followed by desserts and food experiences

- Accommodation and tours close behind

- Plus a long tail of other items such as salads, activities and niche experiences

Two things stand out. First, travelers do not only ask about flights and hotels. They ask about what will make the trip memorable: restaurants, cafes, dessert places, local food. Second, product discovery happens very early in the journey. People ask for "great local food in X" before they have finalized their full itinerary.

Brands Mentioned

Looking at brand level mentions, here is an example focused on travel in Italy:

Even in a relatively small sample, you see a complete ecosystem emerge: trains, buses, car rentals, private drivers and local operators.

For brands, this raises new questions: Where do you want to appear in an AI conversation, at the broad planning stage, or closer to the final booking? How do you make sure your value proposition is clear enough that ChatGPT can explain it correctly to users?

Audience and Geography

A few patterns we frequently observe:

- Most of the travel conversations in our sample are clearly B2C: individuals or families planning personal trips.

- We can further break down conversations by location of the searcher (for example, people searching from the United States about trips to Europe) and by destination.

- This makes it possible to see, for instance, which countries generate the most AI travel planning for a given destination, and which questions dominate in each corridor.

The key takeaway is that travel in AI search is already rich enough to support many cuts: by intent, by product, by brand and by geography.

Conversation Deep Dive

For years, marketers have used the funnel, often broken into three main intent buckets:

- Informational intent: people are trying to understand a problem or opportunity, not yet looking for a specific solution.

- Commercial intent: people are comparing a short list of options and looking for the best fit.

- Transactional intent: people are ready to take action, sign up or buy.

These roughly map to the classic funnel stages of awareness, consideration and conversion. In real life they overlap, but there is a simple tradeoff: as you move from informational to transactional intent, there are fewer users, yet those users are much more likely to buy.

That is why marketers invest in different assets for each step, from top of funnel content and tools to comparison pages and purchase flows at the bottom.

Here is what surprised us when we looked at real travel conversations with ChatGPT.

In many cases, a single conversation quietly becomes the entire funnel. Someone starts with a very general question like:

"What are the best options for a one week trip to Italy in September, starting from Rome, with a moderate budget and a mix of culture and food?"

A few messages later, they are:

- Narrowing down specific routes and use cases

- Comparing 2 or 3 concrete itineraries and accommodation options

- Asking about pricing, logistics and risks

- Requesting recommendations tailored to their exact constraints

- Ready to book, sometimes even asking ChatGPT to help them complete the action

All of that happens inside one session, with no landing page, no retargeting and no long nurture sequence.

Real conversation examples from ChatGPT

Turn 1: Informational

Turn 2: Commercial

Turn 3: Transactional

Video deep dive: full walkthrough of a travel conversation

For marketers and travel brands, this shift from a website funnel to a conversation funnel changes how we think about campaigns, measurement and demand capture.

Industry Perspective

It is useful to take a step back and look at the broader industry moves that shape travel inside AI search.

OpenAI has been steadily pushing toward transactional capabilities inside ChatGPT. During his conversation with Tyler Cowen, Sam Altman used hotel booking as an example of how AI assistants will increasingly handle both discovery and execution. This supports a clear direction where AI becomes not only an advisory layer but also a place where bookings and purchases happen. (Conversations with Tyler)

One of the strongest early signals comes from Booking.com, which launched a dedicated ChatGPT app integration. It lets users describe their trip in natural language, then receive tailored itineraries and direct links to accommodation options. This shows how large travel platforms are preparing for a world where demand originates in AI conversations rather than traditional search engines. (The Verge)

These shifts raise interesting questions for major hospitality groups such as Marriott and other hotel brands. If discovery and comparison increasingly happen inside ChatGPT, travel brands may need to rethink:

- How they appear inside AI assistants

- How inventory is exposed and updated

- How recommendations are shaped and evaluated

The strategic question becomes how hotels and travel operators participate in AI driven distribution, instead of relying only on classic SEO and online travel agency channels.

Conclusion

Travel is already one of the most popular commercial categories in AI search, very close to heavyweight verticals such as laptops, smartphones and investing.

Inside those conversations, we see:

- A strong skew toward informational intent, with 72% of conversations focused on learning and exploration.

- Rich product discovery that goes well beyond flights and hotels, including restaurants, desserts, local tours and experiences.

- A dense network of brands, from large operators to local providers, appearing side by side in the same chats.

- Full funnels compressed into single conversations, from first idea to purchase ready behavior.

For travel marketers and product teams, this opens a few practical questions:

- How do you listen to real AI conversations in your category and turn them into better content and products?

- How do you make sure your brand is visible, understandable and helpful inside conversation based journeys?

- How do you adapt measurement when the key actions happen inside a chat window, not on a web page?

The charts in this article are taken from Aiso (getaiso.com), which offers a free trial with three free searches so you can explore your own category.

If you work in travel and want to understand what your customers actually ask AI assistants, looking into real conversations is the closest thing to reading your customers' minds.